Should I Refinance My Mortgage?

|

| Should I refinance my mortgage? |

If you can get a lower interest rate, you should refinance your mortgage- right? Not necessarily. Refinancing a mortgage costs money. The bank that issues the loan to refinance your mortgage charges origination fees that can amount to thousands of dollars. If you don't end up staying in your home long enough, you can easily end up losing money on a mortgage refinance.

Another unexpected cost of refinancing is that it can extend your payments further into the future, increasing the amount of time you are paying interest. For example, if you have been paying on a 30 year mortgage for 3 years and then get a new 30 year mortgage in a mortgage refinance, you'll be paying interest for 3 more years than if you kept your original loan. Even if the interest rate is lower, this can still add up to more total interest payments over time.

When Can I Save Money If I Refinance My Mortgage?

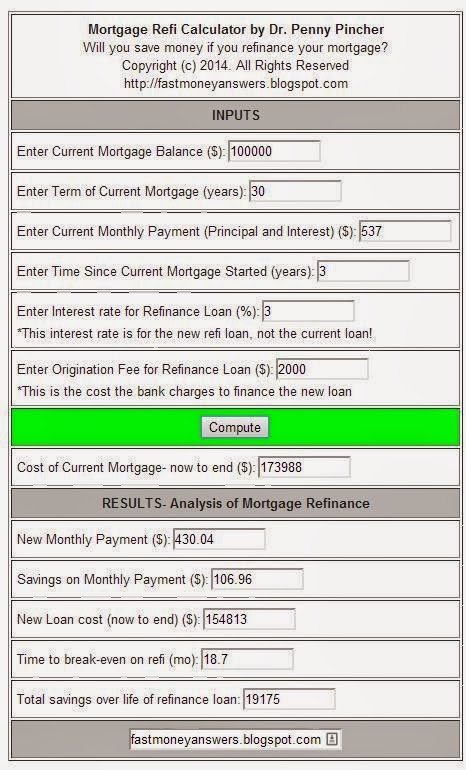

Whether or not you will save money by refinancing comes down to the details: how much lower is the interest rate? How much are the loan origination fees? How long will you stay in your house? A mortgage refinance calculator can help you decide if you should refinance your mortgage. |

| Mortgage Refinance Calculator Image Source: Dr. Penny Pincher |

Using a mortgage refinance calculator will let you determine how much money you can save over the life of the mortgage. The calculator above adds your refinance loan fees to the refinance mortgage amount- which is how most people cover the refinance loan fees. You can see the affect of the lower interest rates on a refi in the form of lower monthly payments. These lower payments save you money every month- until you reach the point where your original mortgage would have been paid off. The calculator above calculates the total cost of your original mortgage and your refinance loan, so you can check the total cost of each and see if you would save money overall by refinancing.

You can also learn how long it will take for your savings on interest every month to cover the refinance loan fees. For example, if it would take 24 months for your monthly savings to cover your refinance loan fees, you would need to stay in your house at least 24 months for a refinance to make sense. If you sell your house before you reach the point where your interest savings have covered your refinance loan fees, then you would loose money by refinancing.

Reasons to Refinance a Mortgage

The main reason people refinance a mortgage is to get a low interest rate and save money on interest payments. If you can pay less and get the same house, why not do it? If you can get a lower monthly payment, you can use the money to pay down high interest debt, such as credit cards. Or, you can keep the same payment and pay off your mortgage years earlier with a refinance. These are good options to have.Another reason people refinance a mortgage is to get out of a variable interest rate mortgage, or balloon mortgage. Some mortgage loans have interest rates that can change over time. You can sometimes get a lower interest rate in the short term, but there is a risk that interest rates will rise and you will end up paying more. Most people who plan to stay in their home for a long time prefer the security of a fixed rate mortgage. This means that your principal and interest payment will never go up.

I Decided Not To Refinance My Mortgage

I recently investigated refinancing my mortgage, but it turned out that it would pretty much be a break-even proposition. It wasn't worth the effort to complete the mortgage application and pay fees to refinance. My mortgage interest rate was already very low, so refinancing would not improve the rate by much at all.The interest rate you have on your current mortgage is largely dependent on when you applied for your mortgage. Mortgage interest rates move up and down all the time, and some years the prevailing interest rate is higher or lower than others. If you got your original mortgage when interest rates happened to be low, there may be no benefit to refinancing. However, if you ended up with a higher rate, you could save a lot of money by refinancing.

The only way to know if you can save money by refinancing your mortgage is to check current rates and see how much you could save.

Recommended Reading:

Credit Card Consolidation Loan Calculator

Copyright © 2015 by Dr. Penny Pincher. All Rights Reserved. Privacy Policy